When you think Dubai, you think money. That’s no doubt largely down to the nation’s many incredible ambitious building projects. The supercars on its streets. And the high rises in its skyline.

But there’s another reason too. Dubai is fast becoming one of the world’s top financial hubs. From its incredible location in the centre of the world’s financial markets, the emirate is home to a vast array of banks, trading houses, hedge funds, and many more financial institutions.

And while the financial services industry is heavily regulated in Dubai, provided you can meet the auditing and compliance criteria, the set-up process doesn’t have to be long-winded.

To ensure a smooth and speedy incorporation process, start your financial services business with the help of Meydan Free Zone. Our team are experts in business setup in Dubai and can help you with licensing, visas, and much more.

What are Financial Services and What are Their Types?

Financial services refers to insitutions that provide their services to people and organisations that need assistance with the generation, investment and management of money and cash flows.

Insurance, budgeting, and brokerage are usually offered by financial services businesses. Dubai is a business hub that bustles with stocks and flows of revenue, money, profits and capital flows, transforming the Emirate into a financial hub with services to aid economic services encompassing financial markets and trade.

Following are some examples of financial services:

- Commercial projects

Attracting and placing funds in commercial business projects/assets, and management. - Operations with securities

Financial instruments, investment and client (intermediary) activities in financial markets. - Financial products

Providing direct and trade financing, issuing credit cards and financial products. - Payment service provider

License of Payment Service Provider (PSP) – activities for receiving and processing payments for third parties. - Investment consulting

Providing a range of services related to optimizing the use of assets, attracting and placing investments. along with careful and detailed analysis of potential markets and projects to invest in. - FinTech licenses

Financial services used to boost business performance and process optimisation with the use of innovative technologies and Big Data, artificial intelligence, blockchain. - Insurance and reinsurance

Providing insurance and reinsurance products and services to individuals and companies. - Creating Investment Funds

Pooling funds of private persons and legal entities for the purposes of joint investment. - Asset trust management

Placement of investors’ funds in company assets and financial products for a fee.

The benefits of starting a financial services business in Dubai

- 0% tax rate on corporate and personal income

- Zero currency restrictions

- Repatriation of capital and profits

- Premier office location

When it comes to starting a financial services company out here, you can immediately take advantage of the country’s 0% tax rate on corporate and personal income.

When you setup in Meydan Free Zone, you will also benefit from zero currency restrictions and repatriation of capital and profits.

And that’s not all. At Meydan, you get a premier location at one of Dubai’s most prestigious addresses, a choice of tailored support packages to help your business get up and running, access to a dynamic living and working environment, and use of our world-class business centre.

Plus, you’ll benefit from a smooth registration process with access to priority government relations assistance and broad support services, along with tailored packages that best address your individual business needs. Starting a financial services business in the UAE can help you unlock perks of conducting business surrounded by effective infrastructure whilst cutting down start-up costs abundantly. With innovative structure to jump-start your financial services business ideas and flexible regulatory environments, conducting your business activities will be seamless in nature.

Steps to start a financial services business in Dubai, UAE

At Meydan Free Zone, we can guide you through the entire process below, starting with company name registration.

It is also important when setting up in the UAE that you align your business practices to the list of permitted activities. There is a wide range of financial services activities to choose from, so you’re sure to find one that matches up. These activities will need to be listed on your license application. And, most importantly, you are not permitted to carry out any operations outside of these. However, you are permitted to add several activities to your license.

It is also important to note here that all financial services businesses in the UAE must be approved either by the Central Bank or by the Emirates Securities and Commodities Authority (ESCA) based on activity name. You can connect with us on 800FZ1 to know more about these business activities.

As part of the conditions of your license, you will need to adhere to UAE’s Know Your Customer (KYC) regulation, as well as Anti-money laundering regulations.

If you intend on operating your business from the UAE, you will also require a visa.

Finally, you’ll need a UAE bank account. Meydan Free Zone can help with this step too, advising on the right bank for your circumstances.

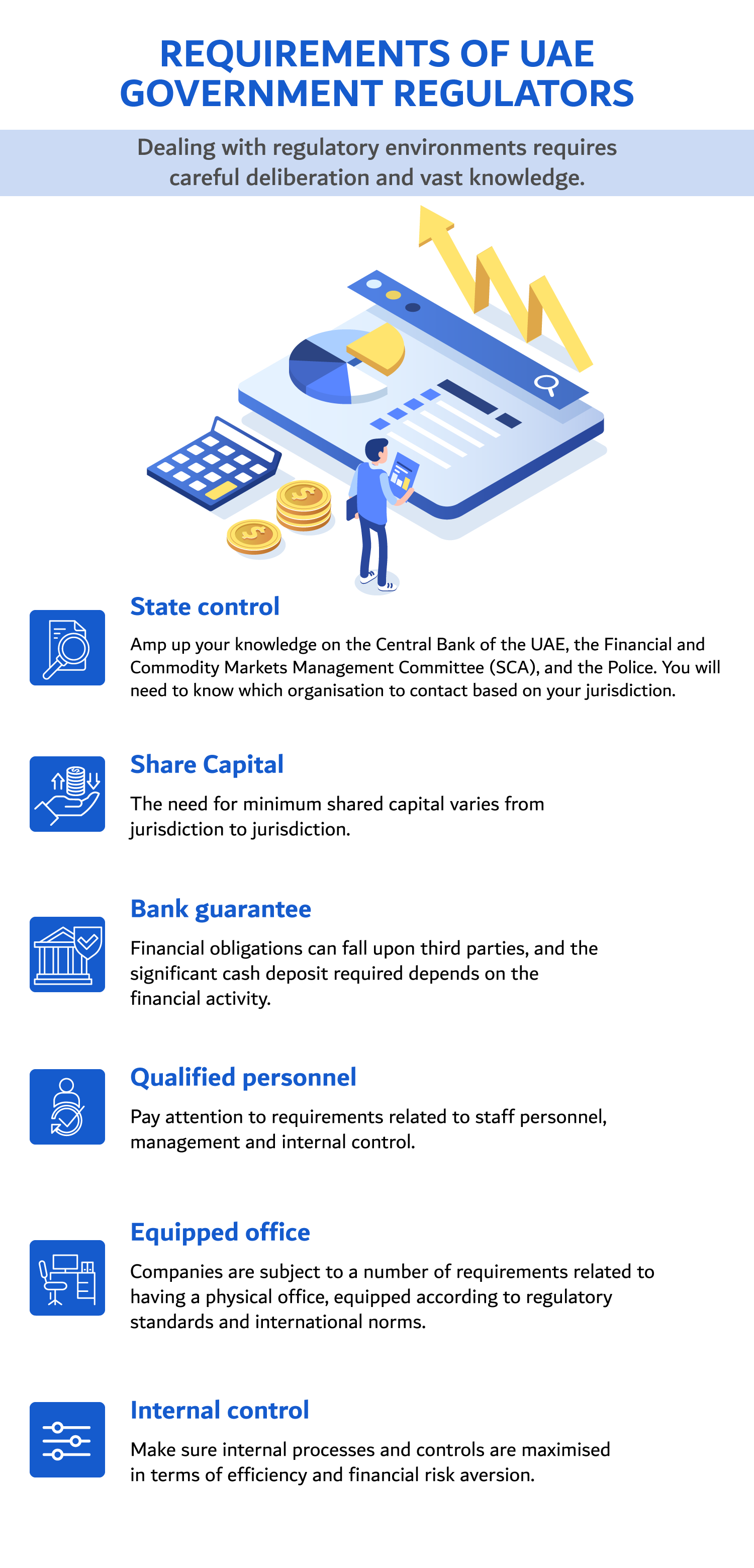

Requirements of UAE government regulators

- State control

There are different state requirements depending on the type of activity and jurisdiction of incorporation. The main regulatory bodies are: CB – the Central Bank of the UAE, the Financial and Commodity Markets Management Committee (SCA), and the Police. - Share capital

In most cases, there are requirements relating to the amount of authorized capital, the minimum level of which varies from 41 000 US dollars to 1.4 million. In rare cases, for complex licenses, the authorized capital required can be as much as US dollars 8-14 million or more. - Bank guarantee

The State has established requirements for a bank guarantee for the fulfillment of financial obligations to third parties. The amount of the guarantee depends on the type of financial or investment activity. Sometimes the deposit required can be quite significant. - Qualified personnel

There are requirements related to staffing levels and skills, covering financial managers, analysts, specialists in internal control over financial transactions, as well as a general manager with the appropriate level of education or qualifications. - Equipped office

Financial and investment companies are subject to a number of requirements related to having a physical office, equipped according to the regulatory standards and international norms. It must be also appropriate for confirming it as the business decision-making center in accordance with the requirements of Economic Substance. - Internal control

Regulators are obliged to ensure a system of internal control is in place and strict compliance with the law in order to minimize risks. They also look for mechanisms and processes that ensure compliance with money laundering legislation.

The cost of starting a financial services business in Dubai

The cost of your UAE financial services license will start from AED 12,500 and will largely depend on the number of visas, offices you may require.

Take your business to new heights at Meydan Free Zone

Meydan Free Zone is a thriving, centrally located economic district with one of the most prestigious business addresses in the region.

We offer our businesses a host of innovative investment and lifestyle benefits in a secure regulated environment that empowers productivity. And we can help you join them too.

Our expert team can assist across the entire company formation journey, from registering your company name to managing your license , visa applications and PRO services.

FAQ 1: What do financial services companies do?

Financial services companies primarily provide assurance and other services to financial institutions like banks, insurance companies, and organisations. Finance can be a tricky prospect to tackle, although it is the basis of all activities operational and managerial. Financial services covers a myriad of transactions including aid in insurance, banking, intermediation, investment and financial planning with utmost ease.

FAQ 2: How to start a financial services business?

You can start a financial services business by examining which activities you would like to pursue in your business, decide on a trading name that adheres to UAE regulations provided by the Department of Economic Development (DED), obtain your professional license by providing proper documentation and contacting relevant authorities, and finally, open up your bank account after applying for needed visas.

FAQ 3: How much does it cost to start a finance company?

In Dubai, you will come across extremely affordable business set-up costs in free zones. Although, if you are looking for lower business costs in general, registering your business in a free zone like Meydan may be ideal. Since financial services come under professional licensing, prices for a license will start from AED 12.500. A business would also incur costs of paying fees to governmental authorities like the Ministry of Economy, visa fees, medical insurance, and application process fees.

FAQ 4: What are the UAE regulations in starting a financial services company?

When starting a financial services company in the UAE, it’s vital to adhere to regulations specific to permitted activities and trade names. Moreover, when tackling banking, gather knowledge on Islamic banking and specific Dubai regulations of business conduct.